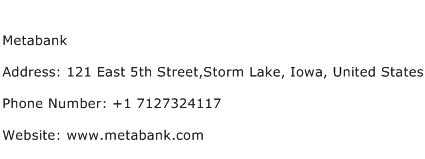

This means that deposits at MetaBank are insured up to $250,000 per depositor. In addition to being regulated by the OCC, MetaBank is also a member of the Federal Deposit Insurance Corporation (FDIC). As a federally chartered savings bank, MetaBank is required to comply with a variety of consumer protection laws and regulations. This means that it is regulated by the federal government, specifically the Office of the Comptroller of the Currency (OCC). MetaBank is a federally chartered savings bank. If you applied for a Netspend card, you likely chose it because of its many features and benefits, such as no monthly fees, no activation fees, and no minimum balance requirements. Netspend is a leading issuer of prepaid debit cards in the United States, and many people choose to use them as a convenient way to store and spend their money. This means that if you are due a refund from the IRS, they will send your payment to MetaBank, which will then distribute it to you via your Netspend card.Īnother reason you might have received a Netspend card from MetaBank is if you applied for one. One possibility is that the IRS has chosen Netspend as their official prepaid debit card provider for tax refunds in 2018. There are a few reasons why you might have received a Netspend card from MetaBank. Why Did I Get A Netspend Card From MetaBank? Netspend is a registered agent of The Bancorp Bank, Axos Bank, MetaBank, and Republic Bank & Trust Company.

Netspend also offers a mobile app that allows customers to manage their account balance, transfer funds, and track spending. Netspend offers a variety of prepaid debit card products, including the Visa Prepaid Card, MasterCard Prepaid Card, and American Express Prepaid Card. Netspend is a provider of prepaid debit cards and related financial services. They are among the ones who issue the debit cards for the stimulus payments. Metabank is a registered card processor that is also the Treasury Department's financial agent.

0 kommentar(er)

0 kommentar(er)